Account receivable turnover in days plus#

number of days of payables outstanding increased from 2020 to 2021 and from 2021 to 2022.Ī financial metric that measures the length of time required for a company to convert cash invested in its operations to cash received as a result of its operations equal to average inventory processing period plus average receivables collection period minus average payables payment period.Īpple Inc. operating cycle deteriorated from 2020 to 2021 but then slightly improved from 2021 to 2022.Īn estimate of the average number of days it takes a company to pay its suppliers equal to the number of days in the period divided by payables turnover ratio for the period.Īpple Inc. number of days of inventory outstanding deteriorated from 2020 to 2021 but then improved from 2021 to 2022 exceeding 2020 level.Īn activity ratio equal to the number of days in the period divided by receivables turnover.Įqual to average inventory processing period plus average receivables collection period.Īpple Inc. Here we have discussed the introduction, examples, advantages, and disadvantages of the ART ratio along with a downloadable excel template.An activity ratio equal to the number of days in the period divided by inventory turnover over the period.Īpple Inc. This is a guide to the Accounts Receivable Turnover Ratio. So, the accounts receivable turnover ratio is a measure of how quickly a company is able to collect the receivable owed by its clients.

Once you know your accounts receivable turnover ratio, you can use it to determine how many days on average it takes customers to pay their invoices (for credit sales). Average accounts receivable (3,00,000 + 5,00,000) / 2 4,00,000.

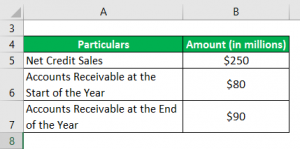

The formula used to calculate the ratio is as follows:Īccounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable Calculating receivable turnover in AR days. Average Accounts Receivable = $85 million.Average Accounts Receivable = ($80 million + $90 million) / 2.The formula used to calculate the average account receivable is as follows:Īverage Accounts Receivable = (Opening Accounts Receivable + Closing Accounts Receivable)/2 The following information is made available from the latest annual report: Let us take the example of a company engaged in trading various wholesale grocery items in California.

Account receivable turnover in days download#

You can download this Accounts Receivable Turnover Ratio Excel Template here – Accounts Receivable Turnover Ratio Excel Template Example – #1

0 kommentar(er)

0 kommentar(er)